Berlin, 25th September 2025 – This week, in its newly published document “Key Points for the Reform of Deutsche Bahn” (i.e. reform of the state-owned rail incumbent DB), the German Federal Ministry of Transport said that it:

• “expects that (Germany’s dominant online rail ticket vendor) the DB Navigator app, together with its associated online presence, will be transferred to the responsibility of (the infrastructure manager) DB InfraGO AG in order to strengthen the common good and competition neutrality“.

This is encouraging, and it must include ticket sales as well.

Background: Two of the key components of the passenger rail sector are (1) the operators on the tracks and (2) the downstream rail ticket sales vendors. With the internet, cross-border rail and new operators, these are no longer the same market anymore.

However, due to their historical role as the national rail monoliths with an ubiquitous brand, state-owned rail incumbents have inherited market dominance not only as the largest rail operator but also in the downstream rail ticket vendor market.

• Unfortunately, in the vast majority of cases, new entrant operators are then refused the opportunity to be sold at such dominant ticket vendors.

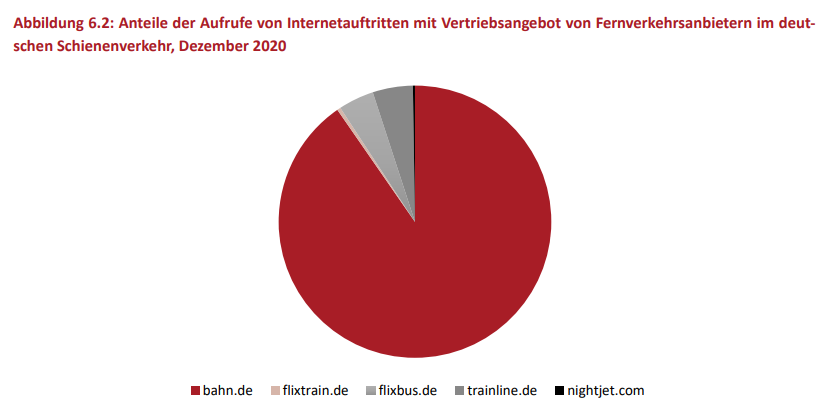

• For example, at the last count, DB’s online rail ticket vendors had an astonishing 94% market share in terms of the number visits to online sales platforms in German long-distance rail (see the pie chart below).

Not only does this reduce transparency for passengers – who cannot see all rail options available – on a publicly owned platform (!) – but it also it is anti-competitive behaviour, severely undermining the exposure to and thus the commercial viability of new entrant operators.

Passengers need multi-channel sales. Market-dominant rail ticket vendors must be required to make available the full range of tickets from all willing rail operators, and market-dominant rail operators must be required to provide data access – including the right to sell their tickets – to all willing ticket vendors.

This way, passengers will experience the benefits of competition in both markets, without one being manipulated by the other.

ALLRAIL Secretary General Nick Brooks says: “The EU Commission and other EU Member States should take note of Germany’s new initiative and ensure that this becomes part of the upcoming EU SDBTR – i.e. the future Single Digital Booking and Ticketing Regulation for rail.

Figure 6.2: Shares of website visits with sales offers from long-distance rail operators in Germany, December 2020. Source: Monopolies Commission, Sector Report Bahn 2021: Wettbewerb in den Takt!, page 119.